ITWorx Develops Venture Capital (VC) Bank CRM Implementation to Manage Its Products and Customers History and Subscription

Customer Profile

Venture Capital Bank (VC Bank) is the first Islamic investment bank in the GCC and the Middle East and North Africa (MENA) to specialize in venture capital investment opportunities designed to drive business growth in portfolio investment and provide risk-adjusted returns on investments. It is positioned to offer its clients a broad range of superior financial services and unique investment opportunities across many promising asset classes, create a pioneering business model, and take a leadership role in institutionalizing investment in the regional venture capital market.

The Challenge

VC Bank, in Bahrain, is the first dedicated Islamic venture capital bank in the GCC and MENA region, offering its customers a broad range of superior services and unique investment opportunities across a number of promising asset classes in the GCC and MENA markets. The bank’s principal areas are venture capital and business development, private equity, real estate, and financial advisory. VC bank has various departments: investment departments responsible for creating ideas and capturing investment opportunities for projects; placement departments responsible for creating business for the bank and contacting investors; and HR and a Support Team in charge of maintaining customer information, following up on payments, and sending reminders to the customers. VC Bank users used Microsoft Excel sheets to add and track their customers’ subscriptions and payments. The preexisting process was time-consuming to track 1000+ customers’ subscriptions to projects between shareholders and investors, leading to the inconsistent data format of customers’ data. VC Bank needed a web system for automating the process of marketing and following up on its projects’ operations and customers’ support.

The Solution

ITWorx has implemented a Microsoft Dynamics CRM web-enabled solution that automates the activities related to products and customers management.

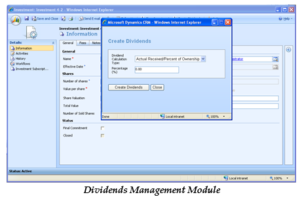

Dynamics CRM implementation provides VC Bank with several product and customer management modules. The Product Management module allows authorized users to manage and maintain product data and transactions; the Investment Management module manages the multiple investments allowed on the same product; the Subscription Management module holds customers’ subscription information in a specific investment; and the Dividends Management module is used for adding payments to the customer.

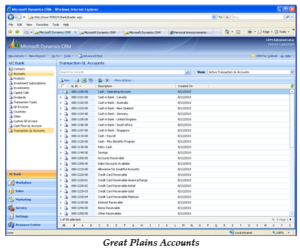

ITWorx solution uses Microsoft Dynamics Great Plains (GP) Cash Flow Company Accounts and Transaction company Accounts buttons to synchronize these accounts every period specified by the administrator.

The system provides a mail notification feature that allows the customers to receive different notifications from the bank like payment instructions, payment delay notification, and updated statements for the customer’s account…etc.

The VC CRM system generates two types of documents that need to be approved by the Chief Investment Officer and Head of HR and Support through defined approval workflow cycles: the Financial statement & Investment statement. The financial statement constitutes a valuation statement that is used to determine the estimated value of a customer’s investment & a cash flow statement that checks the movement of cash on the investor’s current account. The Investment Statement shows shares in every project, dividends, and outstanding payments.

The system includes integration between GP data and Dynamics CRM. Outbound integration is concerned with moving data from the CRM to GP. The CRM will send information about multiple objects, such as customer/account & Payable and Receivable invoices, to GP.

The proposed solution included migrating old data from Excel format to CRM unified, structured Database.

Finally, ITWorx used Microsoft SQL Server Reporting Services to generate valuable reports, with different categorization and filtering, for Product Summary, Investor Summary, Placement Team Performance, and Investor Segmentation. VC Bank administrators will be able to create custom reports, as per business and users’ needs, through Microsoft SQL Server Reporting Services (SSRS) interface.

The Benefits

- Better monitoring of customer business and cases

- Accuracy of customer financial & investment statements through automated approval workflows cycle

- Better insight on business progress through performance and operational management reports